You then multiply this by 0166 20 VAT divided by 120 100 plus 20 to figure out the pence per mile in this case 233p. To find your reimbursement you multiply the number of miles by the rate.

Mileage Log Template Free Excel And Pdf Template With Download

- HM Revenue and Customs HMRC approved mileage rates and allowances.

. To submit a missing mileage claim log into your Royal Skies account and select Missing Mileage Claim from the menu. KM Petrol Mileage MYR 000 Unit Cost MYR 000 OTOFACTS shall not be held responsible for any inaccuracy of calculations. If all details submitted are correct the miles will be credited automatically.

Business Rate 71 through 12312022 per mile. Hi there I need to calculate the travel mileage of a staff. And what is the rate.

Mileage claim calculator 2020. The 2021 irs mileage rates for business and other purposes. Malaysia Distance Chart Distance Table.

The range like some bros mentioned is between 040 to 080. Input the number of miles driven for business charitable medical andor moving purposes. To determine what your business miles are worth multiply the miles driven by the mileage rate set by your employer.

To determine how much you could claim work out how much of the mileage allowance would be used for fuel. The business mileage claim form calculates the amount owed. You drive a company vehicle for business and you pay the costs of operating it gas oil maintenance etc.

Distance from Malaysia Kuala Lumpur to Kota Bahru. Company Name Company name. Select routes Route 1 From To Route 2 From To Route 3 From To Generate Mileage Now Add a Route.

Click on the Calculate button to determine the reimbursement amount. Use the OTOFACTS Mileage Calculator to determine how much fuel your vehicle consumes. Business Rate 11 through 6302022 per mile.

The staff lives in A and works at our branch there and was asked to cover for our branch in B. Case Study How this company saved S1300 a month by using mileage claims. Select your tax year.

WapCarmy is the Malaysian leading source for you if you are searching for mileage claim calculator malaysia in malaysia. Gsa is updating the mileage reimbursement rate for privately owned automobiles poa airplanes and motorcycles as required by statute. The allowance amount can either be calculated using.

This will display the dropdown with suggested places in Malaysia. Some company will provide transport allowances and better still petrol card thrown in also. In this situation you cant use the standard mileage rate.

Miles rate or 175 miles 0585 1024. Irs mileage rate for 2021. I hear something as ridiculous as RM020km this one based on current fuel price just enough to cover petrol only while i am claiming Rm080km.

Maintenance service wear tear Including major service say 20k KM cost divide back to RMKM. WapCarmy is the Malaysian leading source for you if you are searching for mileage claim calculator malaysia in malaysia. Calculate mileage deduction based on the standard mileage rate.

Wear and tear is very subjective. 68 cents per km for 201819 and 201920. This online Expense Claim Software helps the HR Human Resources departments manage the company Car Claims Car Mileage Petrol Claims Business Mileage.

Select the desired Address Place City Village Town Airport from both the dropdown lists. As of June 2018 a 1401cc to 2000cc petrol car would have an AFR of 14p per mile. Proton New Saga BLM 11-14kml.

Please read our disclaimer. For business medical moving and charitable purposes. Earn 600 enrich points per rental with budget.

Travel Expense Claim - need to calculate the travel mileage of a staff. 26 rows Enter the Distance To city village town airport or place name from Malaysia in the second text box. Just type in the name of a town in Malaysia and where we have it well show population data and the nearest towns in miles and kilometres along with estimated travel times and data download optionsYou can vary the distance radius from 10 miles up to 999 miles to find towns near to your place of interest.

Call us at 65 6337-8016 or 8377-9547. The average car mileage reimbursement provided to all levels of. Your mileage reimbursement would be 12208 224 X 585 cents 13104.

Wonder if you guys travel for for company business by own car Do you claim mileage. You can quickly calculate the approved amount for a car journey by breaking your total mileage down into the first 10000 miles and any mileage above this then multiplying the two resulting numbers by the 45p and 25p rate. Otherwise please allow up to 4 weeks for your claim.

Beginning january 1 2021 the irs standard mileage rate for personal car use will be 56 cents per mile for business use a decrease of 15 cents 16 cents per mile for medical and moving mileage a decrease of 1 cent and 14 cents per mile for charitable organization mileage no change. WapCarmy is where you can explore the most updated information about mileage claim calculator malaysia on one page for free including the latest car news In-depth articles covering the automotive industry car video car. For the calculation do we cover to and fro to B or only cover the expense to B.

Mileage Claims Standardise your petrol claims using this industry tool. Use otomy to reach over 2000000 car buyers on Malaysias 1 automotive network. You can also enter airport name or code from Malaysia in above fields.

Instead a portion of the rate is applied equaling 27. Below we will update the average fuel consumption of all car in Malaysia. April 5 2011.

For example lets say you drove 224 miles last month and your employer reimburses at the Standard Mileage Rate of 585 cents per mile. This means that if an employee has used their own rather than a company vehicle to make business journeys they need to be reimbursed via mileage expenses. This is because its meant to cover both the.

New 2021 irs standard mileage rates for business medical and moving. On 442011 at 1032 PM Quantum said. Select your mileage preference Mileage Preference 3.

Mileage claim rate in malaysia 2020. All the information you need to submit your mileage claim is available on your e-ticket. Calculate how much income tax you will be paying in 2021.

.png?width=960&height=1274&name=Mileage-step3%20(2).png)

Findity Features Business Mileage Expense Calculation

Car Logbook App By Driversnote

Mapping The Location Of Malaysian Dry Ports Source Authors Download Scientific Diagram

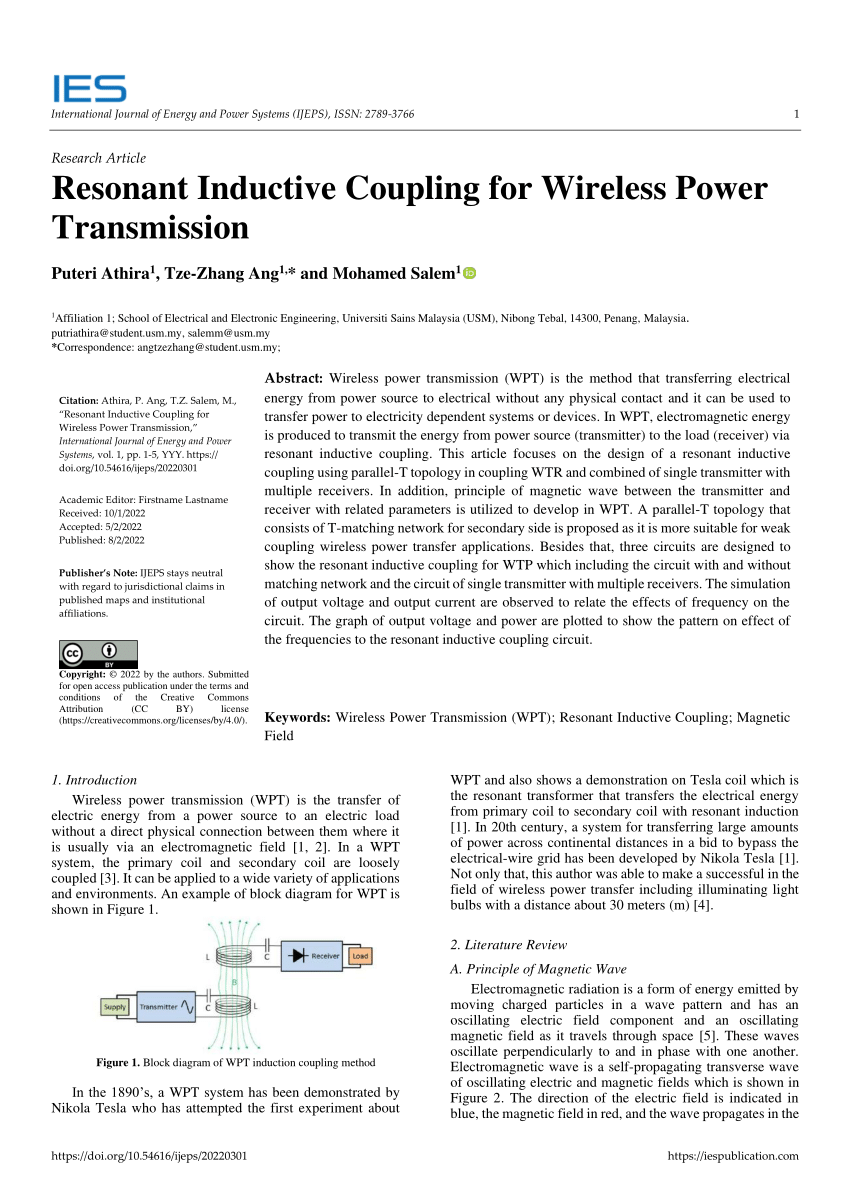

The Structures Of Basic Compensation Topologies Download Scientific Diagram

The Structures Of Basic Compensation Topologies Download Scientific Diagram

Findity Features Business Mileage Expense Calculation

Reimbursement Form Template Word Fresh 26 Sample Claim Forms In Word Mileage Reimbursement Elementary Lesson Plan Template Lesson Plan Templates

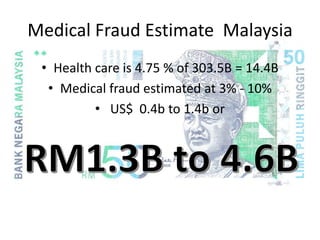

Medical Fraud And Its Implications Dr Vaikuthan Rajaratnam

.png?width=960&height=1274&name=Mileage-step1%20(2).png)

Findity Features Business Mileage Expense Calculation

Mileage Log Template Free Excel And Pdf Template With Download

Honda City Hybrid Launched In Malaysia Honda City Honda Honda Fit

Mileage Log Template Free Excel And Pdf Template With Download

Vehicle Programs The Average Car Allowance In 2021

Pdf Electric Vehicles In Malaysia And Indonesia Opportunities And Challenges

Expense Reimbursement Services Malaysia Intune Outsourcing

.png?width=960&height=1274&name=Mileage-step2%20(2).png)

Findity Features Business Mileage Expense Calculation

Malaysia Budget 2022 Crowe Malaysia Plt

Profit And Loss Statement Template Free Download Freshbooks